|

Parts one and two will present findings from a recent executive summary conducted by business and consulting firm Frost & Sullivan. With the exception of one graphic, UniformMarket was given permission to run the report in its entirety, the first part of which appears below. In part three, the industry responds. We’ll dissect the findings and get reaction from top leaders and executives. Do the conclusions match the industry’s expectations? Will the economic downturn forever change the uniform landscape, or is it a mere blip in the marketplace? Introduction to the North American Workwear and Uniforms Market The report first established three overarching findings related to uniforms in the workplace:

The main purpose of issuing workwear is to ensure the safety of the employee and to give him or her a corporate identity or image. It can be an exceptional advertising tool, and many employers choose to issue workwear to their staff as a marketing strategy. Working clothing is gaining popularity worldwide, and the North American market, being one of the fast-evolving markets, is likely to witness a huge opportunity to increase the penetration. It is very well likely to reflect the future of the workwear market throughout the world. This research identifies major trends and challenges within the North American workwear market and details market size and segmentation from 2005 to 2015. This workwear and uniforms research is separated into three main market segments. First is “General Workwear,” which is further broken down into blue and white workwear. Blue workwear is made up of clothes worn by trades people and workers in heavy industry and manufacturing. Generally, these clothes include coveralls, shirts, jackets, boiler suits, aprons, warehouse coats or overalls. White workwear is made up of clothes worn by employees in the healthcare and hospitality industries. Medical uniforms and chef’s white uniforms are the examples for this type. The second market segment is the “Corporate Workwear/Imagewear,” which includes career wear and casual workwear. Career wear is made up of workwear used for office-based jobs and customer-facing airline workers. It’s also known as business clothing / business wear / corporate clothing. For men, the business wear includes shirts, trousers, jackets and blazers. For women, it ranges from skirts, trousers, jackets and blouses. The other portion of this segment is casual workwear, most frequently used in logistics and tourism. This type of clothing is typified by the T-shirt or polo short. The third and final market segment is “Uniform.” This is any workwear issued to personnel in the uniformed public services, such as armed forces, law enforcement personnel and postal services employees. Workwear Research Overview This research includes detailed explanations of:

Summary of the North American Workwear Market Forecasts The North American workwear market is growing slowly at a rate of 0.2 percent. The percent of employees given workwear is ranging from 35 to 40 percent. The market has grown steadily at just over 5 percent annually until 2007, and then the growth slowed down to 0.2 percent in 2008 because of huge job losses in the second half of the year. Then the growth is expected to be halted for 2009 and 2010. The market is expected to bounce back from 2011. The market attained revenues of $10.5 billion in 2005, and by 2008 this had grown to $11.7 billion. By 2015, the workwear market in North American is likely to reach the annual revenues of $14.5 billion. Although women make up 55 percent of the workforce, the uniform and apparel industries sell only 20 percent women’s garments in the market. The remaining women workers wear the men’s garments. The scenario is expected to change in the forecast period, and there is an excellent opportunity for the manufacturers to grow in the women’s segment of the workwear market. Market Drivers and Restraints There are variety of drivers and restraints having an impact on the market. The most important drivers, restraints and challenges for the North American markets are listed individually. Market Drivers:

Market Restraints:

Industry Challenges:

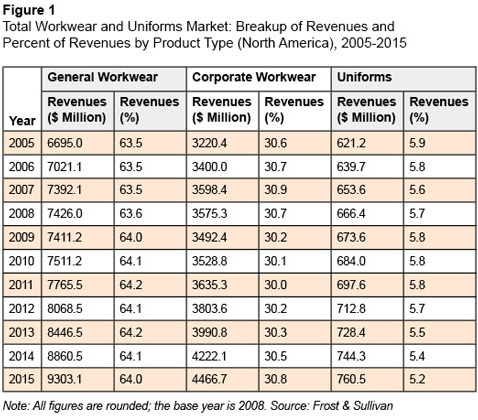

Market Segment Analysis General workwear made up 63.5 percent of revenue sales in 2005. This is a steady market, where there is not likely to be much difference in contribution. By 2008, general workwear made up 63.6 percent of revenues. By 2015, general workwear will constitute 64 percent of revenues. General workwear is the least expensive segment in the workwear market, with corporate wear and uniform having more expensive garments in the form of suits and other tailored items. The demand for the general workwear is dropping because there are only a few people employed in the manufacturing and heavy industry in North America. The market for corporate wear is also steady in North America. From a share of 30.6 percent of revenues in 2005, it has maintained a 30.7 percent market share in 2008. Between 2009 and 2015, there is expected to be a slight drop and then a rise in this market. The drop is likely to occur mainly because of the job losses that happened in many sectors, such as the financial and the banking sectors. The difference between the corporate wear segment and the two other segments of this market is that it is not vital that an employer supplies their workers with corporate wear. With general wear and uniform, there is a distinct need for workwear: to prevent soiling of clothes or for identification purposes. However, no one who wears corporate wear actually needs to. This means that the companies that experience financial hardship are likely to cease issuing them to their employees as a cost-cutting measure. Although the corporate wear market is growing steadily; this growth is, by no means, assured year on year. Any recession or political troubles in a country are likely to hit this market harder than it does the others. Uniform segment is maintaining a steady market share as it is mainly dependent on essential public services. In 2005, the uniform segment of the North American total workwear and uniforms market amounted to $621.2 million in revenues. By 2008, this had increased to $666.4 million. The increase in the size of the uniform market is largely due to the fact that the numbers of personnel in the U.S. armed forces have increased in the period following deployment in Iraq and Afghanistan. However, the recent announcement of troop withdrawal made by the president of the United States is likely to have a marginal effect on the military uniforms market. By 2015, the market is predicted to have a share of 5.2 percent.

Note:

|

| Above story first appeared in MADE TO MEASURE Magazine, Fall & Winter 2009 issue. All rights reserved. Photos appear by special permission. |

| Halper Publishing Company 633 Skokie Blvd, #490 Northbrook, IL 60062 (877) 415-3300 Fax (224) 406-8850 [email protected] |