At first glance, being included on The MATCH List might seem like an opportunity to meet someone new on Match.com. However, in credit card processing, no Merchant wants to find themselves on the Member Alert To Control High-Risk Merchants list, also known as The MATCH List. It’s also known as The Blacklist in Merchant Services.

What is the MATCH List?

The MATCH list is a record of merchants considered to carry an unacceptable level of risk. Banks and payment processors use this list to identify merchants that expose them to high-risk transactions and business practices. If you find yourself on the MATCH list, you will struggle to open a new Merchant Account with any processor while you’re on the list. Mastercard’s acquirers are required to consult the list before onboarding any new merchant, and in most cases, will reject any merchant on it.

What is the TMF List?

Prior to MATCH, merchants may have found themselves on the Terminated Merchant File (TMF). MATCH is the replacement for TMF. It was originally created by Mastercard to help acquiring banks identify high-risk merchants before boarding them. There is no formal notification process to Merchants placed on the MATCH list. Most find out when their current Merchant Services Provider terminates the relationship and the Merchant attempts to open a new Merchant Account and is rejected.

Causes to be Added to the MATCH List

Earning a spot on the MATCH list is most commonly caused by excessive chargebacks. It is most likely to be an acquiring bank that places a Merchant on this list but can also be done by a card brand such as Mastercard. If the acquiring bank terminates a merchant account due to excessive chargebacks, Mastercard requires the bank to add you to the MATCH list. Other factors include illegal activity, bankruptcy, fraud, money laundering or illegal transactions. Failing to maintain PCI Compliance can also get a Merchant blacklisted.

The Consequences

Mastercard has no appeal process for a merchant who feels their acquirer has treated them unfairly. If an acquiring bank terminates your Merchant Account, you will be labeled a high-risk merchant, and most institutions will not do business with you or will charge you exorbitant fees. Your business will be unable to accept credit cards for payment. In some cases, you may be blacklisted by all credit card networks such as Visa, Mastercard and American Express. Being unable to accept credit cards in the plastic world we live in can be the kiss of death for your business.

Getting Off the MATCH List

Depending upon why you were added to the list, your options for being removed are quite limited. If you were added because you are non-compliant with PCI-DSS, you can be removed once you become compliant. For most other reasons, there is no recourse unless you were added by mistake. The only way to get off the list is to wait five years when list entries expire.

Avoid Being Placed on the MATCH List

For the most part, merchants can avoid being added to the MATCH list by staying compliant with all standards and regulations and maintaining low rates of chargebacks and fraud. The maximum chargeback ratio is 0.9% of your total transactions.

The 5-Year Sentence

Once placed on the MATCH list, Visa and MasterCard prohibit Payment Facilitators from working with you. Companies such as Square and Stripe also cannot accept such merchants. The MATCH list contains the legal name of the entity, DBA(s), URLs, and principal owner(s) and address information. Branded as a risky business, you will find it nearly impossible to open any new merchant accounts elsewhere – for 5 years!

The Bottomline

Ending up on the MATCH list is almost a certain death for most Merchants as more people use credit and debit cards than cash these days. Being on the MATCH list shows that your business caused so many problems that your Merchant Account was terminated and that makes other acquirers and payment processors wary of doing business with you in the future.

Who is Aurora?

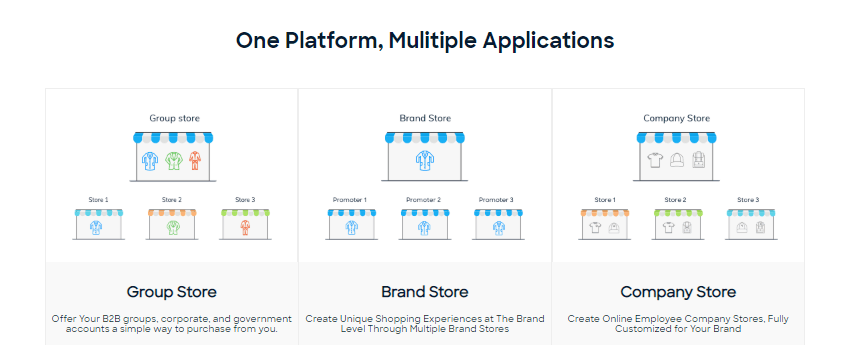

Aurora Payments is a network of professionals providing Merchants with reliable payment solutions for any industry and any environment. We help businesses increase efficiency and growth. Our proprietary technology provides One Ecosystem – One Contract – One Partner – One Aurora. As a Full-Service Provider (FSP), we have the all the products, services, solutions, and support Merchants need – all-in-one place. We’re an organization driven by a passion for helping our Merchants succeed. Interested in learning how you can eliminate credit card processing fees? Send us an email at [email protected] or call us at 833-287-6722. You’ll be saving money in no time!